Fraud Alert Response and Compliance Board 8157536030 6182062806 8662071337 8135879622 5705710020 8084003903

When you receive a fraud alert, it’s crucial to understand what it means for your financial security. The Fraud Alert Response and Compliance Board offers valuable resources to help you navigate these situations. With direct contact numbers like 8157536030 and 8662071337, you can get the support you need quickly. But knowing how to respond is just the beginning. What steps should you take next to ensure your protection?

Understanding Fraud Alerts and Their Importance

When you receive a fraud alert, it’s crucial to understand what it means and why it matters.

Fraud alerts are vital for protecting your financial freedom and rely on effective fraud detection techniques.

By staying informed, you enhance your consumer awareness, empowering yourself to recognize potential threats.

This proactive approach helps safeguard your assets and ensures you’re always in control of your financial well-being.

Steps to Take When You Receive a Fraud Alert

Receiving a fraud alert can be alarming, but knowing how to respond can make a significant difference.

Start with alert verification; confirm the source’s legitimacy. Next, review your accounts for suspicious activity, enhancing your fraud detection measures.

If you notice anything unusual, report it immediately. Take proactive steps, like changing passwords, to safeguard your information and maintain your financial freedom.

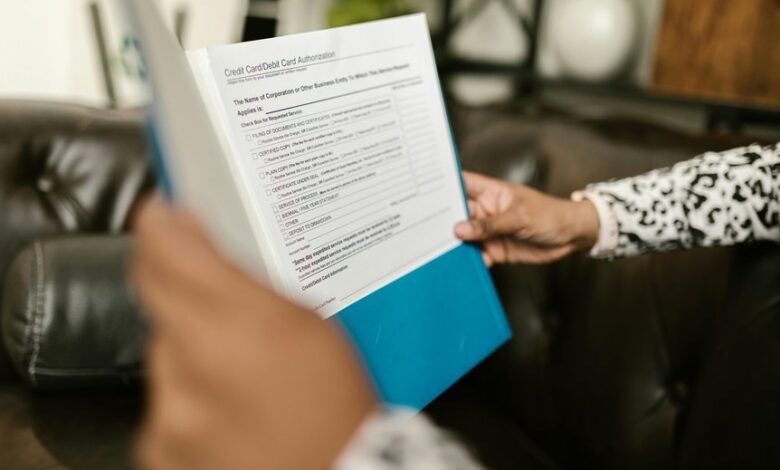

Resources and Support From the Fraud Alert Response and Compliance Board

Although navigating a fraud alert can be challenging, the Fraud Alert Response and Compliance Board offers valuable resources and support to help you manage the situation effectively.

You can access fraud resources tailored to your needs, ensuring you have the information you require.

Additionally, their compliance support assists you in understanding your rights and responsibilities, empowering you to take informed action against fraud.

Preventative Measures to Protect Against Fraud

To effectively protect yourself against fraud, it’s essential to implement proactive measures that reduce your vulnerability.

Stay vigilant with fraud detection tools, monitor your accounts regularly, and use strong passwords.

Be cautious when sharing personal information online to prevent identity theft.

Educate yourself about common scams and report any suspicious activity immediately to safeguard your freedom and financial security.

Conclusion

In conclusion, staying informed and proactive is key to protecting yourself from fraud. Did you know that 1 in 15 people fall victim to identity theft each year? By utilizing the resources provided by the Fraud Alert Response and Compliance Board, you can better navigate potential threats. Don’t hesitate to reach out to their support numbers for assistance. Empower yourself with knowledge, and take the necessary steps to safeguard your financial well-being against scams.